Next Generation Fintech for RWA Trade Finance

Hi-Tech Cloud Solutions for

Embedded RWA Trade Finance

Quick, High Quality and Low Cost Transactions

BIG NEWS #1 - 🚀 BIG MILESTONE FOR US AT TOKNAR!

Great news just confirmed — Google for Startups Cloud Program has granted TOKNAR $200K! 🎉🎉🎉

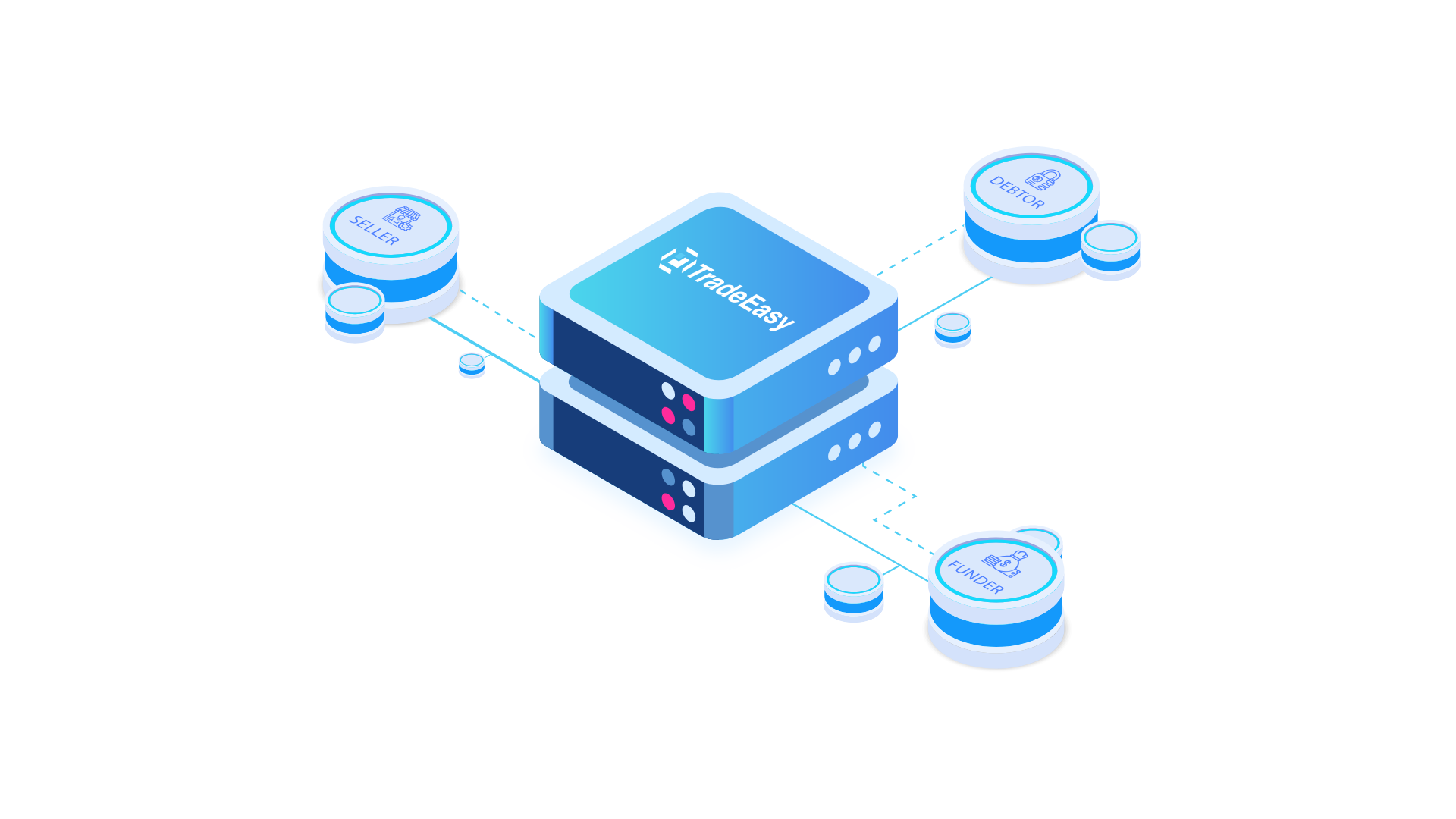

💪TOKNAR is on a mission to bring embedded RWA Trade Finance to SMEs through its cloud solution TradeEasy, unlocking value from illiquid trade finance assets where it’s needed most. 💪

🌍 Couldn’t be prouder to see Google joining our growing ecosystem alongside Fasanara, XDC Network, and Plug and Play. 🌍

✨ Exciting times ahead — we’re just getting started! ✨

BIG NEWS #2 - TOKNAR Selected To Join Plug&Play Accelerator @ Silicon Valley

TOKNAR has been selected to join the Plug and Play XDC RWA Accelerator Program! 🚀🙌

BIG Thanks to our new “Partner” XDC Network!

Latest Teaser - Next Generation Financing

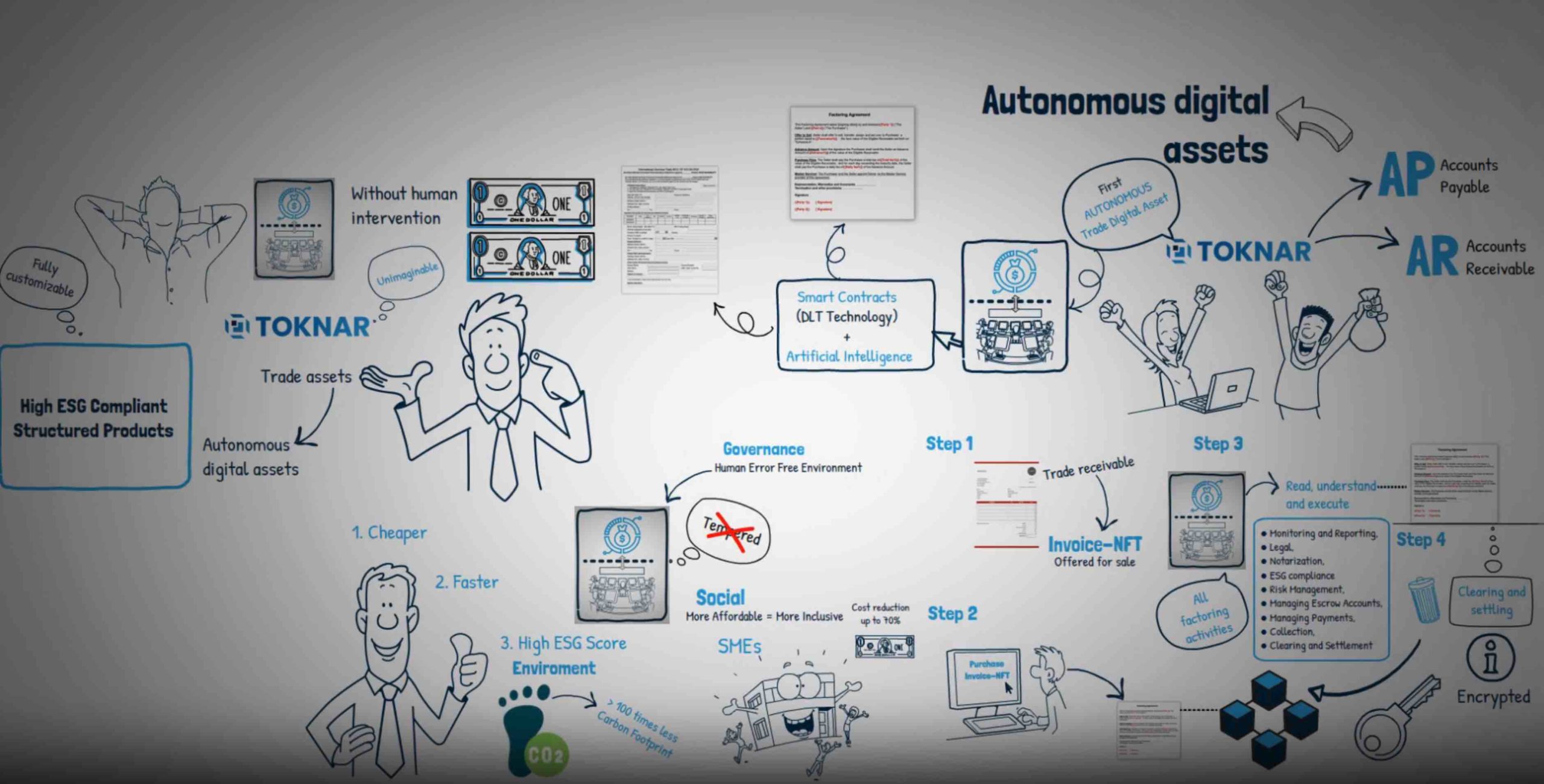

“We’re entering a future powered by the token economy — where real and financial assets are tokenized for greater liquidity, transparency, and global accessibility. “Teaser - Next Generation Financing

“At Toknar we’re targeting the largely untapped €1 Trillion market of SMEs eager to sell their trade receivables.”

ART - Accounts Receivable Token

“By integrating Artificial Intelligence capabilities, we transform ART into a highly enhanced NFT, akin to an NFT on steroids”

Toknar

1:01

3:52

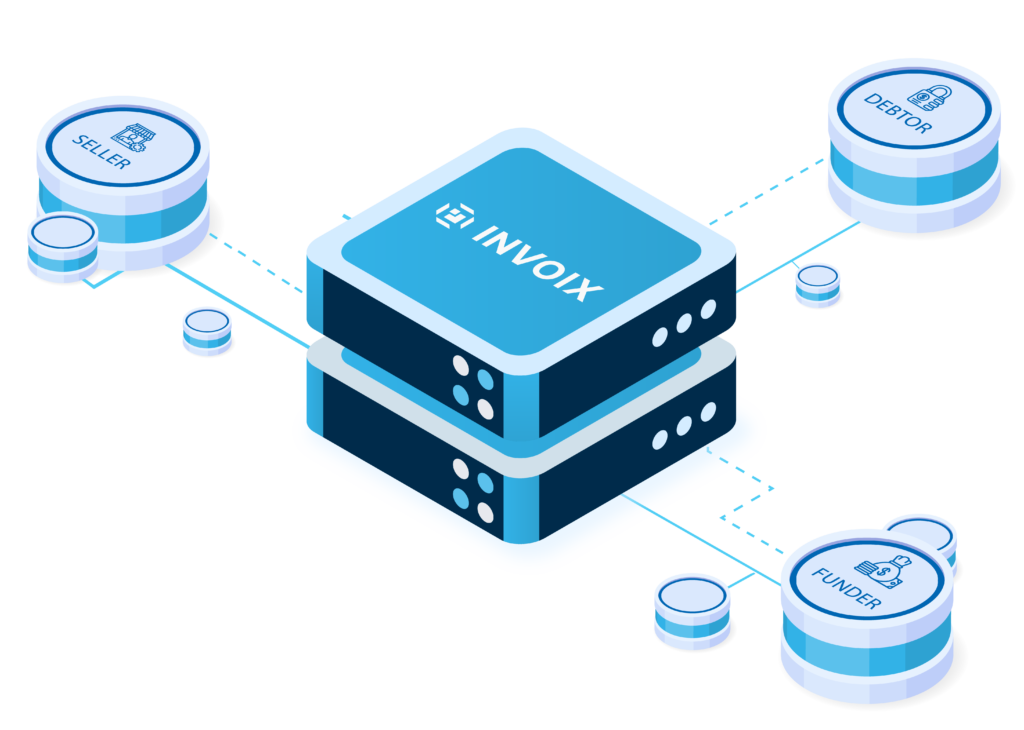

Most Innovative SaaS for Invoice Financing

B2B

We use our proprietary INVOIX TECHNOLOGY™ to offer financial institutions and corporate customers WEB 3.0, fully customizable digital platforms.

SaaS

TOKNAR designs and offers WEB 3.0 digital platforms in SaaS (Software as a Service) for “invoice factoring,” “reverse factoring” and “trade receivables securitization.”

Smart Contracts

What makes our approach unique is our innovative (proprietary) technology solutions based on AI / ML and DTL technologies, which enable our “smart contracts” to read, understand and execute the clauses of any factoring agreement without human intervention. As a result, the machine can do the job of a whole factory team, significantly reducing operating costs and time.

Our Hi-Tech

Advanced Analytics

Our advanced analytics enable us to analyse receivables pools, assess reserves, create reports and provide comprehensive dashboards for Clients

ML and AI Automation

We employ cutting-edge Machine Learning, Smart Contracts, Distributed Ledger Technology, and Artificial Intelligence to run all the required servicing activities in invoice financing

Cloud Technology

We deploy unlimited computing power, effective data backup and smart disaster recovery from our secure and private virtual cloud systems

TradeEasy

We use our proprietary TradeEasy™ to offer bespoke Embedded Trade Finance cloud solutions to fit our clients needs

MORE THAN A DIGITAL PLATFORM

INVOIX™ DIGITAL PLATFORM FOR INVOICE FINANCE

More Than A Digital Platform

INVOIX™

INVOIX™ is a multifunctional B2B digital platform specialising in invoice finance, which employs our proprietary INVOIX TECHNOLOGY™.

We can customise and integrate our INVOIX digital platform into the client’s IT system to meet all the needs of a client involved in invoice financing (invoice factoring /receivables securitisation).

INVOIX™ is a powerful digital platform with a series of modules that can be employed to custom build capability.

- Risk Module: Realtime Assessment of Required vs Actual Reserves, Anomalies Detection

- M&R Module: Monitoring and Reporting

- Eligibility Module: Realtime Assessment of Invoice Eligibility

- Legal module: Smart Contracts and Notarisation

- Payment Module: Payment Management

- C&S module: Clearing and Settlement

- Collection Module: Collection of Overdue Invoices

- Grande Module: Parcelisation of Very Large Receivables

- Account Module:

- Escrow Account

- Collection Account

- Daily Sweeping

Software integration

Fully Dedicated To Finding The Best Integration To Your ERP To Make Servicing Easier Than Ever